The Moral Market Fallacy

Many conservatives and libertarians are deeply confused about the morality of markets. They view markets as pure and benign forces with the ability to grant moral righteousness to any behavior that comes from them. This is profoundly wrong.

Markets, like gravity and inertia, are natural occurrences–wild and unfeeling in their actions. Markets are far more complex, of course, but just like the others they blindly produce outcomes without thought of moral repercussions. Inertia puts baby strollers in front of moving cars, and gravity pulls hikers off of mountains. A critical mistake is made when markets are seen differently.

People deprioritize morality as soon as markets enter the conversation. In U.S. healthcare, for example, people too often suffer and die because their insurance companies have cancelled their policies due to excessive use. A child is dead. A father is dead. A mother suffers for lack of medicine. All this because their provider put money before human livelihood. When confronted with such evidence, the common response from the market fetishists is:

Let the markets do their job. The problems arise when people like you, or the government, step in and interfere with markets that should be left alone.

This is precisely like a primitive civilization celebrating a broken piece of pottery because their revered God of Gravity was responsible for its death. Or, more accurately, a broken child.

Natural forces don’t produce moral outcomes by themselves; they are morally inert. It is up to humans to discover or build their own morality, and to strictly define and adhere to it. This morality–whatever it ends up being–then becomes the framework for acceptable behavior, and anything that causes us to deviate from it is unacceptable.

We must remember that markets are tools and nothing more. They are not equal with our moral framework, or even part of it. They are simply a means of accomplishing our goals within the context of our own priorities, and just as gravity, or wind, or heat from the sun–tools must be controlled.

Even Adam Smith–the author of The Wealth of Nations and supposed champion of unbridled markets–knew this:

Such regulations may, no doubt, be considered as in some respects a violation of natural liberty. But these exertions of the natural liberty of a few individuals, which might endanger the security of the whole society are, and ought to be, restrained by the laws of all governments. The obligation of building party walls, in order to prevent the communication of fire, is a violation of natural liberty, exactly of the same kind with the regulations of the banking trade which are here proposed. ~ Adam Smith in The Wealth of Nations

The number of market worshipers who are aware of Smith’s position on this is frighteningly low.

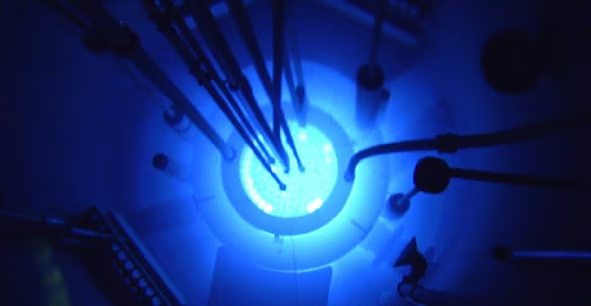

Nuclear reactors are tools as well, and notice the safeguards we put in place to protect ourselves from them. We don’t embrace nuclear fallout when it happens, and ask that HAZMAT teams respect the radiation. No, we protect our people and their livelihood first, because our moral priority is on human livelihood.

The obvious truth is that it should be no different with markets, and the fact that otherwise good people are not seeing this is causing cutting deep wounds into our country. ::