How to Calculate and Communicate Your Desired Total Compensation

Negotiating how much you make at your jobs is one of the most important things you’ll do in life.

This structure applies to many salaried positions but usually not jobs that pay hourly.

Unfortunately, many are quite unprepared for the process, and that starts with not realizing there are multiple layers to a complete compensation package, with salary being only one of them. I decided to go ahead and write this piece after seeing a number of Twitter threads > where there were vast ranges of compensation for similar jobs, and realized that I could possibly help with awareness.

The key thing I want you to take away from this piece is that you need to be negotiating Total Compensation—not just salary—for your next role.

The technical term for compensation is actually remuneration (re-MOON-eration), which people invariably pronounce as renumeration (re-NOOM-eration).

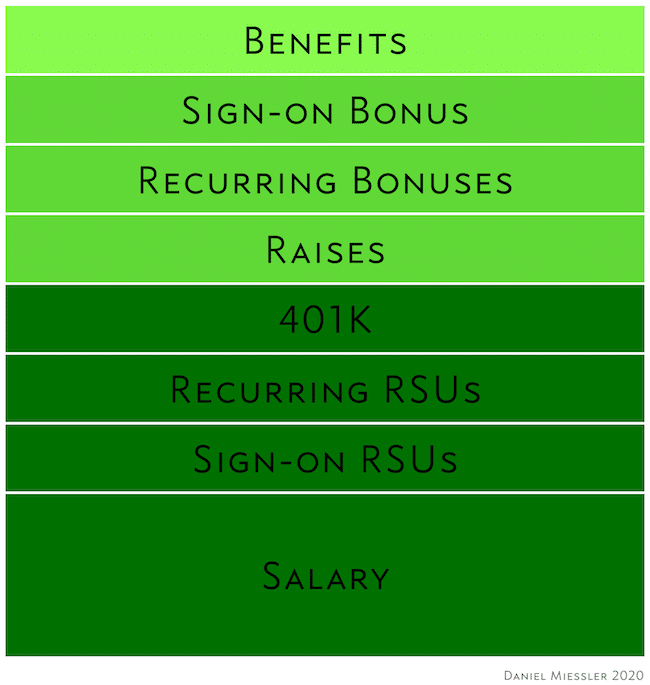

Ok, now that you know that Total Comp (as they call it in the biz), is about a lot more than just salary, let’s look at the individual pieces. You can think of Total Comp as having the following 8 components. Yes. 8.

Sign-on Bonus: Your sign-on bonus is a cash amount you receive immediately after starting, but it’s often broken into two or more pieces. For example, one half after 6 months or a year. A decent sign-on bonus would be something like 1/4 of your first year’s salary, and a great one would be half or more. Keep in mind that bonuses are taxed like gifts, which means you only get a bit more than half.

Sign-on RSUs: Sign-on RSUs are an extremely important component of your compensation package. This is often the most important chunk of equity you’re getting in the company, and could even drive how much you get in the future. Use your research to determine how much it should be, but the range should be somewhere between 2-4X what you make in salary.

Salary: While the whole point of this article is to stress how salary is just one component of overall compensation, it’s still a crucial one. Salaries pay bills, while RSUs, raises, bonuses, and other types of compensation are a lot less tangible. Salaries are often the most regulated and restricted within companies as well, so you can’t easily ask for something 1.5 or 2 times higher than is being offered. The only exception to that is if you happen to know that those numbers are possible but simply aren’t being offered to you. The best advice is to 1) find the bands for your position if possible, 2) do your research on what others are making in similar roles, 3) ask for the top of the band, and 4) if they’re still not getting close, tell them that you just need to be slotted as a higher position to get you into the salary range desired. Finally, if they’re unable or unwilling to budge, either get that extra amount through another part of the overall package, or tell them you’re not interested.

401K: Many companies in non-growth industries don’t have RSUs as part of their compensation plan. For those industries, one of the most important aspects of your compensation is your 401K, which is basically a way to stash away money without it being taxed when it gets withdrawn. What you want to look for here are 1) does the company have one at all?, 2) do they do matching?, and 3) how much matching do they do?, and 4) do they allow matching beyond the no-tax limit?. In general the more matching they do, up to higher percentages of your salary, is better. And if they do so above the no-tax limit of around 18K/year, that’s even better.

Some companies adjust compensation quarterly rather than annually, and this is especially popular in sales-oriented jobs.

Raises: Raises are usually given anually, and they tend to be fairly locked down as well. They’re usually based on some combination of your performance (merit), the performance of your local team, and the performance of the company overall. Again, try to find out as much as possible about what’s normal for the company, and shoot for the high-end of that. But this is one of the values that’s likely to be fairly static.

Different industries weight compensation to different parts of this stack.

Bonuses: Bonuses are similar to raises in that they’re usually defined by HR for a set period of time for set types of positions, and they tend to not get negotiated much. Just make sure you’re not being offered some bonus amount that’s lower than other people, based on any data you have.

Stock/RSUs: RSUs are where you can make up a lot of ground on salary and bonuses if those aren’t as pliable as you’d like. Companies often have far more freedom sweeten deals with stock than any other component. If you feel like you’re significantly low on salary, see if you can get where you want with more stock. Also keep in mind that there are different types of stock-based compensation >, and that RSUs are generally preferred. Finally, do keep in mind that stock is only as valuable as the company is, and that depends on many factors. The leadership, the product, the economy, etc. Factor that all in when you’re thinking about how much value a company’s stock has relative to salary.

Pay inequality is a big problem in tech, especially for underrepresented groups like women and minorities. The best way you can help is by sharing yours. I’ll go first.

?: B.A. – C.S.

⏳: 5.5 years

?: Staff/G06

?: NYC

?: $205k base, $500k equity over 4 yrs#KnowYourWorth >

Be sure to get college, conference, and training promises in writing so that they don’t become liquid negotiations during the year during budget conversations.

Benefits: One of the most overlooked aspects of the overall pay conversation is benefits. It’s not just about how much you pay to fill a prescription. You can actually work quite a few great perks into an overall package under this banner. One of the biggest ones in this category is whether you can work from home—either all or some of the time. If you live outside a major city or state, and you want a great job with a great company, being able to work remote will be a major part of your compensation story. Maybe you’ll make less in salary, but you’ll also need less. And if you live in a big city but hate the commute, the freedom to work from home part of the week will be extremely valuable to your overall health. The other things to consider are how much PTO you get (in increments of weeks per year), and how much continuing education and training is available. Will they pay for you to go to college, and if so how much? And how many conferences and trainings can you attend during the year.

Ok, so those are the components. Now let’s talk about the negotiation itself.

How to negotiate your desired package

The first step to getting what you want, what you’re worth, and what you deserve, is to research. The more information you have about the process in general—but especially the process and general packages at the place you’re interviewing—the better off you’re going to be.

One of the best resources out there for these comparisons is levels.fyi >.

You want to spend multiple hours Googling around to find out what typical compensation packages look like for that company, or similar companies if necessary. Put a list of those in a spreadsheet to get a feel of their structure. Look on Glassdoor. Check Twitter. Look on the various salary comparison sites >.

Make a spreadsheet of all the various components above, for the data you find. Salary, stock, bonuses, etc. Gather as many examples as you can find.

Next, figure out what you want to be paid. What would truly make you happy? What would make you feel like you had truly made good choices up to this point, and that you’re now being compensated for those sacrifices? Think of that number as a Total Comp number. Like, $400K.

We’ll work forward from there.

I’m using security as the example because it’s the field I know best.

Next, carefully ping around in your network to see what they make. Some are sensitive about this, so you might have to approach the question differently with different people. But friends should be willing to tell you if you’re on the right track.

Ask questions like:

Hey, I’m looking at getting a security manager role at a Fortune 50 company, and I have like 8 years experience. I’m thinking of a package worth around $350K, with salary of X, RSUs of Y, etc., etc., and that seems in line with my research. You’re in the space, so what do you think?

If you do this enough, with at least a few good connections, you should get a solid read on if you’re way too low or too high in what you’re looking for.

So now you have a bunch of numbers from online research. You know what would make you happy. And you have tempered those numbers with a few recent data points from friends and associates.

Your North Star on compensation should be a package that makes you feel good about yourself and your accomplishments up to this point in your life.

So now you want to set your desired total compensation. My general advice is to find the upper end of what you’ve found in your research, make sure it’s near what you had as your initial target that would make you happy, and add 25-50%. Yes. Really.

You can always work down, but you can’t easily work up once you’re low. Believe in yourself.

As a rule—for most non-C-level salaried positions—you want to be asking for a total compensation package that’s somewhere between 1.5 and 3 times larger than your salary. So if you’re making $100K/year in salary, with not that much experience, you want to be looking for at $150-$200K in total comp. And if you’re making $175K/year in salary, with over 10 years experience, be thinking about $350-$450K/year in total comp.

Offer time is basically the only time you’ll have to negotiate these items, so go into the conversation prepared.

Keep in mind that out of the eight different components, the HR group you’re negotiating with often has more leeway in some of those areas than others. So it could be that you ask for a higher salary and they come back and say they just can’t do it. That might be true, but maybe you could ask for more annual RSUs in exchange. Or more in bonuses, or more PTO. Again, it’s a package. So you should feel empowered to push and pull on various levers during your negotiation to get where you want to be.

Also keep in mind that some of these benefits are compound in nature, like the various percentages within a 401K, and stock (if it ends up doing well). So you probably want to put extra weight on those where applicable. There is no time better than the offer stage to have these conversations.

The most important thing to remember is to do your research online, ask around to people in the space, know what would make you happy, and aim high (25-50% more) from there.

That is your Total Compensation number, which you will open with when you start the conversation with the recruiter.

A brief word on imposter syndrome

Many people face something called Imposter Syndrome >, which is an oppressive feeling of not being the real thing. People with this feel they’re always one event away from people discovering that they don’t deserve to be in the position they’re in, making the money they’re making.

People with this mentality are at an extreme disadvantage when negotiating compensation because they often feel—especially during these conversations—that they should just be happy to not be fired for being an imposter, let alone to be getting a paycheck! So it’s very hard for them to even imagine asking for more, finding out what others are making, and pulling levers within the package to get to their goal.

Many reading could be written about Imposter Syndrome, so I won’t be able to solve it in a paragraph, but let me just say this:

You are better than you think you are.

There is no Tribunal of Fairness where the best people get the most money. Most people making a lot of money just have high opinions of themselves (usually extroverted males), and they make more because they confidently ask for it (and often because of bias). It doesn’t mean they’re any better at their jobs than you are.

The world of salaries is not zero-sum. You’re not taking food off the plates of some mythical "more competent person" by asking for better compensation. The world doesn’t care who gets paid more, and it might as well be you.

If you’re in tech (especially in security) there aren’t nearly enough people on this planet Earth with your skillset.

Many of the great people in the world, and many of the best security people I know, also have Imposter Syndrome. Try to get rid of it by realizing your worth, but when that fails, wear it like a badge. Some of the smartest and nicest people in the world are introverts. Own it, and turn it into a strength!

Summary

Ok, that was a lot. Here’s what you need to remember.

Compensation is about far more than just salary, and actually has at least 7 components.

Do your research, know what you want, and then aim higher to arrive at your Total Compensation number.

When you enter into the pay conversation, start with something like, "Ok, let’s talk about total compensation." That will tell the recruiter that they’re dealing with someone serious and educated on the matter.

Keep in mind that some parts of the package will be more flexible than others for the recruiter. Keep the conversation locked on your TotalComp number, and keep the challenge on them to find a way to get you there.

Negotiating pay throughout your career is one of the most important things you will ever do in life. It’s a dance, with a process. And the more you know about it the better.

And most important of all—believe in your worth—and don’t be afraid to ask for it.

Notes

Like Imposter Syndrome, the topic of biases in compensation is also worthy of several reading. I normally take a "lead quietly by example" approach to addressing bias, but in the case of compensation, I would encourage under-represented groups to double-down on their research phase of this process, and to directly bring that into the conversation when talking with the recruiter. Be willing to say something gentle but firm, like, "Yeah, so I see here that Trevor Howell here in my research seems to be making over 60% more than what you’re offering, and I’m just trying to figure out what could be the difference between me and him, since we both have similar skillsets and experience." Again, you want to do this in a non-aggressive and friendly way, but you want to make it clear that if they have bias in their system—it may be that it’s affecting other people, but it isn’t going to affect you. Recruiters are extremely sensitive to this in recent years, as they should be, and it could be that simply raising this in their minds could cause them to reach out to others, find out if that type of comp is really possible, etc. The beauty is that this works both when the recruiter is participating in passive or active bias against you, and when they’re not! If you have someone who’s being prejudiced or discriminatory, they might respond favorably out of self-preservation, and if you have someone who’s modern and trying their best to be completely neutral, they might be able to adjust purely out of having the new information. So, do it nicely, but in general I advise you to come to the table with data and shoot your shot if you think the package you’re being offered is too low due to bias.

This article is heavily focused on technical and management roles, and other types of roles—even in tech—don’t pay nearly as much. It’s also focused on high-end tech jobs, and represent the top few percent of salaried positions. If you work in normal industries, in normal roles, you’re probably not nearly as underpaid as this piece makes it sound.

Keep in mind that in many states you don’t have to share your previous salary information, either verbally or in a pay-stub form, with the recruiter you’re talking to. Often times this is just a tactic to get you to doubt yourself and be happier with a smaller package. You are not the same person you were when you took that last job. This is a net-new conversation!

Thanks to Jason Haddix for reading through and offering additional tips before publishing.

Thanks to Saša Zdjelar for calling out the importance of 401K in non-growth sectors.

Thanks to Mark Hillick for some great tips on the overall process.