A Correction is Coming, and That’s Ok

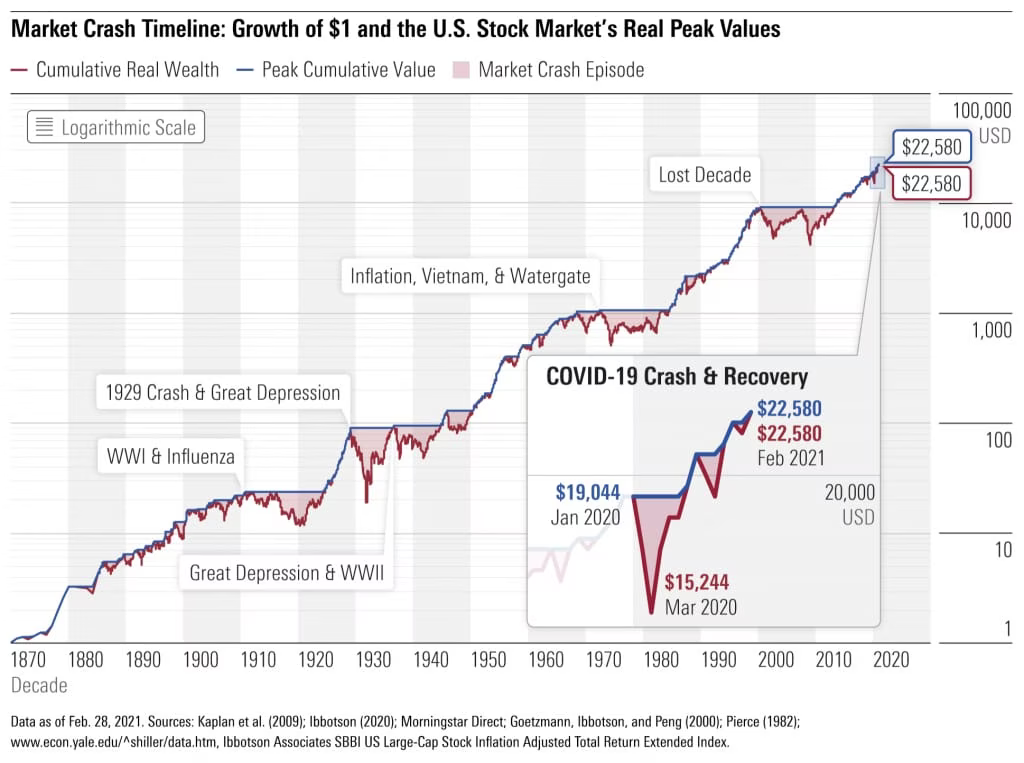

People have been talking about a stock market crash correction for years now, and for good reason. We’ve seen massive growth for years that’s usually followed up by a drop (see above).

But I’m tracking another narrative that’s pretty damn compelling—namely the narrative of "So what?" If you draw a line through that graph—including all the crashes—it’s absolutely heading upwards.

Simple doesn’t always mean right.

So my read on this is pretty simple: Yes, we might have a correction soon, in fact we should expect one. But that doesn’t mean you shouldn’t be in stocks.

The only question is how long you plan to be in the game.

If you are trying some sort of scheme to get rich quickly, with this stock or that stock, yes—you might get burned by a correction. But if you’re buying solid stocks, or index funds, and you plan on holding them for 10, 20, or 30 years, I think the data shows you’re pretty safe.

We’ve seen lots of market crashes, but not a single one that wasn’t followed by stocks hitting new highs.

Now keep in mind—this doesn’t account for a total collapse of the economy, or the downfall of the United States, or the end of civilization. There are no guarantees that past trends will continue.

My only point here is to not be overly concerned about the trend of corrections, becase that trend sits within the trend of recoveries that take stocks even higher.

Summary

People think we’re likely to see a correction in stocks soon.

The data show that this is likely, although nobody knows when it will be.

Some think this is a reason to avoid stocks.

I and others think a correction is not only likely, but virtually guaranteed, and that this is only scary if you are working some sort of short-term scheme.

If you are investing in the stock market longterm, using strong stocks and/or index funds, you will likely survive this coming dip to see the other side.